Tips On How To Calculate The 7 Price Measures

This means the business needs to promote 5,000 items to cover all fastened and variable costs. Working leverage refers to the percentage of a company’s total value construction that consists of fixed quite than variable prices. But in the case of variable costs, these prices improve (or decrease) primarily based on the quantity of output in the given interval, causing them to be much less predictable. Tracking fixed prices is essential for small enterprise house owners as a result of it varieties the idea for efficient financial planning and decision-making. In particular, a transparent understanding of your fastened costs permits you to set correct budgets and calculate essential monetary metrics corresponding to your break-even level. Business insurance policies usually operate on fastened premium buildings, making them predictable month-to-month or annual expenses.

A prime example of a fixed value would be the hire a company pays month-to-month for office house and/or manufacturing facilities. This is usually a contractually agreed-upon term that does not fluctuate except both landlords and tenants comply with renegotiate a lease settlement. For instance, if Status Clothing’s whole fixed expenses have been $300,000 one 12 months and so they produced 15,000 shirts, the average fastened value per shirt is $20. Effective budget planning includes analyzing fixed prices and integrating them into pricing methods, break-even analysis, and long-term monetary targets. Companies could make knowledgeable choices about price management, pricing, and scaling operations by understanding the position of fastened costs in budgeting. This ensures companies remain financially stable even during difficult durations.

They play a vital function in informing critical business choices, such as breakeven analysis and working leverage. Mounted prices have a direct impression on the break-even point, as a end result of BEP represent the baseline bills that must be coated earlier than a business can start to make a revenue. This is as a end result of mounted prices don’t change regardless of the number of units bought. Therefore, a enterprise needs to generate sufficient revenue from gross sales to cover these prices. As a result, when fixed costs increase corresponding to as a result of higher rent, salaries, or insurance coverage, the enterprise must promote extra items or generate extra income to interrupt even.

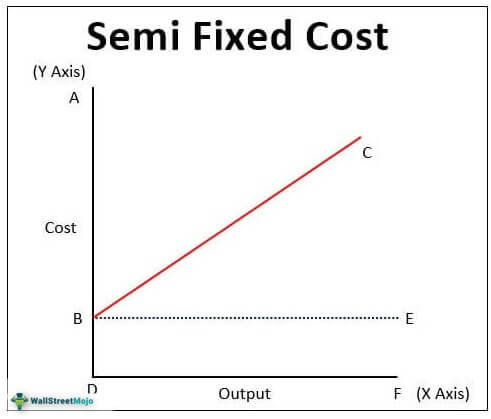

It Is essential to notice that not all costs could be neatly categorized as either fixed or variable. The COGM is then transferred to the completed goods stock account and used in calculating the Value of Items Bought (COGS) on the revenue assertion. FreshBooks makes it easier for small enterprise owners to store, track, and access the data wanted to develop their businesses. Strive FreshBooks free, and find out why hundreds of thousands of individuals worldwide have chosen this cloud-based accounting software.

Take your studying and productiveness to the following degree with our Premium Templates.

Information To Monetary Statements

They’re relevant to fixed prices because each contribute to the general cost construction of a enterprise, as the whole value of a services or products is the sum of both kinds of costs. Long-term liabilities related to mounted prices such as a lease or a loan for capital tools recorded under non-current liabilities on the balance sheet. These obligations represent mounted prices the company should pay over a period of time. The ongoing portion of fastened costs that relate to current expenses, corresponding to lease or insurance coverage, are sometimes reflected in the earnings assertion (profit and loss statement) as expenses. Therefore, whereas fastened prices themselves don’t directly appear on the balance sheet, their impression is seen by way of the depreciation of assets and the recording of related liabilities. Unlike mounted costs, variable prices are immediately related to the worth of manufacturing of goods or companies.

- Subsequently, while fixed costs themselves don’t immediately appear on the stability sheet, their impact is seen through the depreciation of belongings and the recording of associated liabilities.

- Examples are monthly rental paid for lodging, wage paid to an worker, and so on.

- The quantity of gross sales at which the fastened prices or variable costs incurred could be equal to each other is recognized as the indifference point.

- It includes costs like curiosity, utilities, hire, wages, costs of products sold (COGS), and more.

- By contemplating fastened prices in the pricing determination, businesses can ensure they cowl all bills and generate profits to proceed working and investing in growth and advertising campaigns.

- High volumes with low volatility favor machine investment, whereas low volumes and excessive volatility favor using variable labor costs.

As Soon As businesses have recognized all their fixed prices, they can allocate these expenses inside their budget. Since many fastened prices are predictable and constant, budgeting for them helps companies project their money move precisely. By contemplating fastened costs in the pricing determination, companies can ensure they cowl all expenses and generate profits to continue working and investing in development and advertising campaigns. Fixed costs are completely different from variable prices, which change based mostly https://www.simple-accounting.org/ on how a lot you produce or promote. For instance, if you run a bakery, the value of flour and sugar will go up the extra muffins you bake.

How Do Mounted Prices Work?

Whereas electricity and fuel utilization sometimes range with consumption, some businesses negotiate fixed-rate contracts. A small producer might arrange a onerous and fast monthly rate of $1,200 for electrical energy to keep away from seasonal fluctuations and finances extra effectively. Let’s take a better look at the company’s costs depending on its stage of manufacturing. In the second illustration, prices are mounted and don’t change with the variety of units produced.

What’s A Breakeven Level, And How Is It Calculated?

Average fastened cost means the mounted price of a unit within the product process. Firms with business fashions characterized as having high working leverage can revenue extra from each incremental dollar of revenue generated past the break-even level. As an organization with excessive operating leverage generates more revenue, extra incremental income trickles down to its operating revenue (EBIT) and net income. A company’s costs classified as “fixed” are incurred periodically, so there’s a set schedule and greenback amount attributable to every price.

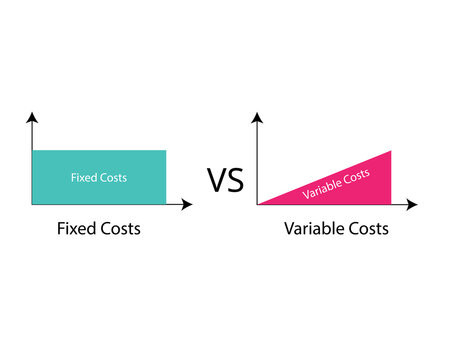

Fastened costs are expenses that stay constant over a particular period, no matter production or sales ranges, while variable costs fluctuate immediately with the level of production or gross sales. Mounted costs, such as rent or salaries, don’t change whether a business produces 1 unit or 10,000 models. In distinction, variable prices, like uncooked materials and direct labor, enhance as extra models are produced.

Then, we’ll explain how a enterprise manages its personal mounted costs and evaluate some widespread fixed price examples. Variable costs are less predictable as a end result of they modify based on how much your business produces, which makes budgeting and monetary forecasting tougher. Their month-to-month fluctuations can reduce into your revenue margins, especially in periods once they spike significantly. They obtain the identical paycheck whether or not the restaurant serves a hundred prospects or 500 customers in a week. The hourly kitchen workers and servers create variable prices since their pay depends on scheduled hours and enterprise quantity. Fastened and variable prices are key terms in managerial accounting, utilized in various forms of analysis of monetary statements.